Chamber welcomes Bank of England interest rate cut to 4.25%

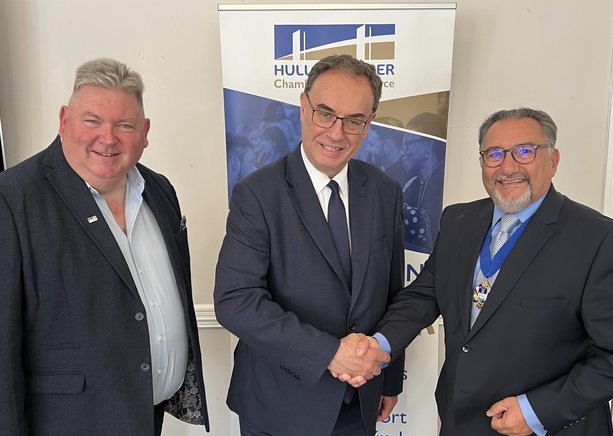

Bank of England Governor Andrew Bailey is pictured with Chamber President Kirk Akdemir (right) and Chief Executive Dr Ian Kelly after a recent lunch at Healing Manor with senior business leaders.

TODAY’S quarter of a percent cut in interest rates by the Bank of England has been welcomed by the Hull & Humber Chamber of Commerce.

The Chamber’s External Affairs Director, David Hooper, said: “Today’s cut is a welcome move for hard-pressed businesses as the interest rate was cut to 4.25% from 4.5%. The nine-person MPC was split as five members wanted the cut to 4.25%, two wanted a bigger cut to 4%, while two wanted no change.

“Hopefully there will be more cuts to come in the coming months!

A spokesman for the British Chambers of Commerce said: “Today's interest rate cut will help absorb some of the shocks that businesses are facing on multiple fronts. Our research has been clear that SME sentiment has been falling since the twin developments of domestic tax rises and a global trade war.

“Many firms, desperate for financial respite, will be keen to see further rate cuts in the months ahead. National insurance hikes, alongside other cost pressures, are already having an impact, including increased prices, hiring freezes, and reduced investment. BCC has been calling for a tax roadmap to give firms some idea of when pressures will ease.

“On the global front, today’s announcement on a framework deal between the US and the UK could help improve business and investor confidence. However, the impact of the wider tariff war will still be felt. Progress elsewhere, such as the EU-UK reset and this week's trade agreement with India will be significant, though their full impacts may take months to be seen.

“The next few months are likely to remain volatile, and the full impacts of a global trade war, are still uncertain. Businesses will be looking to Government to provide stability and avoid any further pain."